Dropbox, Inc. has transitioned from being a startup success story to a mature player in the cloud storage and collaboration space. Over the years, the company has steadily grown its revenue and expanded its customer base, but now faces the challenges of market saturation and increased competition.

In this article, we will explore the long-term financial trends that have shaped Dropbox’s current position, analyze its latest Q2 2024 results, and assess the company’s future strategy, particularly its focus on AI. With AI-driven tools like and significant investments in the AI ecosystem, Dropbox is looking to transform the way knowledge workers manage and interact with content. This analysis offers an in-depth look at Dropbox’s key financial metrics, competitive strategy, and future growth potential.

1. Long-term Financial Trends: A Strategic Review of Dropbox’s Growth

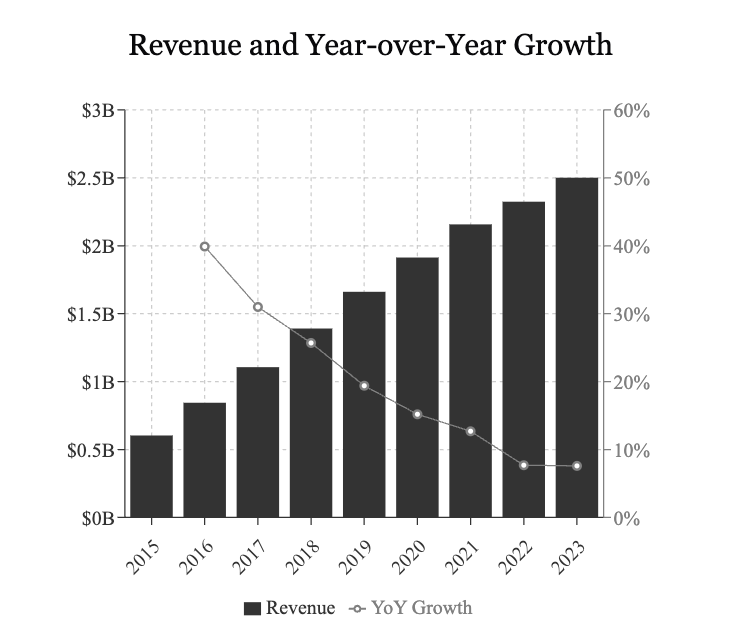

Revenue: Steady Growth, but Slowing Momentum

Dropbox's revenue trajectory over the past decade reveals a company that has transitioned from rapid startup growth to a more mature and stable business. From 2015 to 2023, Dropbox’s revenue increased from $603.8 million to $2.5 billion, reflecting a CAGR of approximately 19%. The years between 2015 and 2019 saw particularly robust growth, with revenue increasing by an average of 25-30% annually. However, as Dropbox expanded its market share, this growth rate began to decelerate, settling at 7.6% in 2023.

Dropbox’s journey into a $2.5 billion ARR company highlights both its operational efficiency and challenges related to growth saturation. In recent years, the company’s primary revenue drivers have stemmed from its expansion into enterprise accounts and the introduction of products like Dropbox Business, which allows teams to collaborate seamlessly. Yet, the slowing revenue growth—especially from 2020 onwards—signals the company’s struggle to continue scaling at previous rates. This deceleration is further evidenced by declining new customer acquisitions, despite maintaining strong Non-GAAP operating margins (33%).

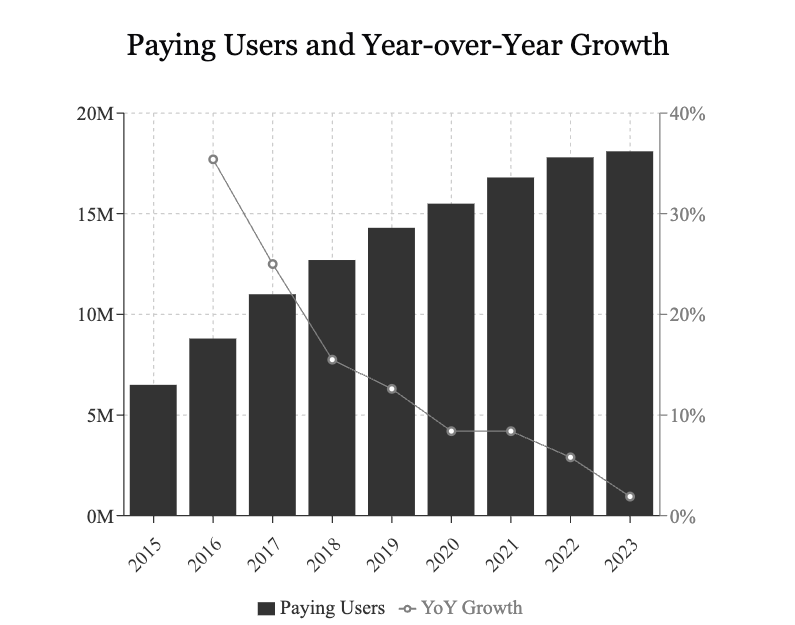

Paying Users: Saturation in Market Reach

A key metric for Dropbox's business health is the number of paying users. Dropbox’s paying customer base expanded significantly between 2015 and 2020, growing from 6.5 million to 15.5 million. However, the pace of customer growth also slowed after 2020, reaching at 18.1 million in 2023, with only a 1.9% year-over-year increase. This suggests that Dropbox has reached near-saturation in its core consumer markets, particularly as the service is already ubiquitous among tech-savvy users.

This saturation is complicated by competitive pressures from larger tech companies like Google and Microsoft, which offer bundled cloud storage solutions at competitive rates. Dropbox’s strategy to counteract this saturation has involved expanding into adjacent verticals, such as collaborative tools and AI-powered features. However, the challenge remains in driving significant user growth, particularly in the face of such stiff competition.

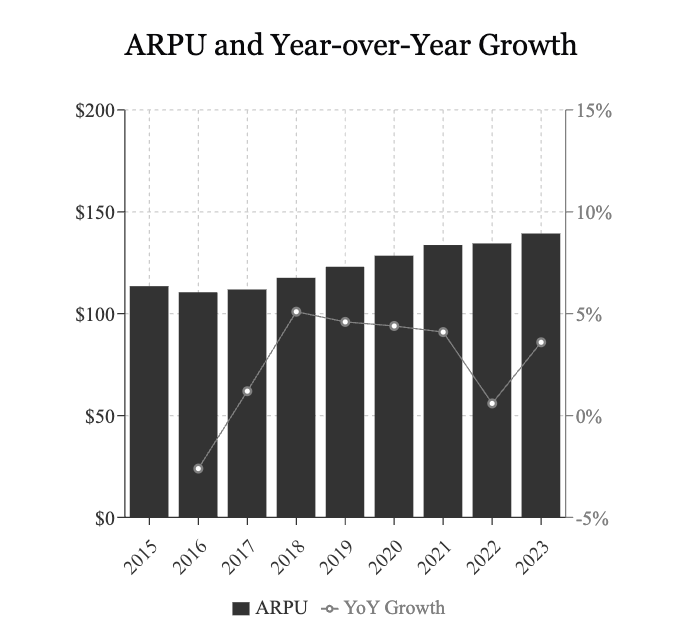

ARPU: Modest Gains Through Price Adjustments

Average Revenue Per User (ARPU) is another critical measure for Dropbox. Since 2015, ARPU has seen modest increases from $113.54 to $139.38 in 2023, growing by about 2-4% annually. However, ARPU has remained relatively flat in recent years, reflecting Dropbox’s pricing power limitations in its saturated markets. Incremental price hikes and new product offerings have helped to sustain this modest growth, but ARPU gains are not significant enough to drive large-scale revenue expansion.

The company's freemium pricing model has been integral to its strategy, particularly in the early stages of growth. Offering basic services for free while charging for premium features has been highly effective in user acquisition.

2. Current Financial Performance: Q2 2024 Breakdown

Revenue and Key Metrics

Dropbox's Q2 2024 results reflect a company navigating the challenges of maturity. Total revenue for the quarter was $634.5 million, representing a 1.9% year-over-year increase. Although this growth appears modest, this period marked the slowest growth Dropbox has seen since its early days as a public company. On a constant currency basis, revenue grew by 1.8%, indicating some headwinds from currency fluctuations.

ARR and User Growth

Dropbox’s ARR reached $2.573 billion, up 2.9% year-over-year, with ARR increasing by $17.3 million quarter-over-quarter. This growth is driven by the addition of 63,000 new paying users, bringing the total paying user base to 18.22 million, up from 18.04 million in Q2 2023. This quarter-over-quarter increase suggests Dropbox is still expanding its paying customer base.

Operating Margins and Profitability

Dropbox’s GAAP operating margin for Q2 2024 was 20%, a significant improvement over the 9.1% margin reported in the same period last year. This increase is attributed to the absence of workforce reduction costs incurred in 2023. Additionally, Dropbox reported a non-GAAP operating margin of 35.9%, up from 34.2% year-over-year. The company’s strong operating margins reflect its focus on efficiency, even as revenue growth decelerates.

Moreover, Dropbox’s free cash flow for the quarter was $224.7 million, a 22% increase from the previous year. This impressive cash flow generation underscores the company's ability to generate substantial cash even in a slower growth environment. Dropbox’s strong cash position of over $1.06 billion further highlights its robust financial health.

AI Investments and Strategy

A significant portion of Dropbox’s forward-looking strategy involves its AI initiatives. Dropbox Dash, an AI-powered universal search tool, is key component of the company’s effort to integrate advanced machine learning into its core products. This represents an important strategic pivot as Dropbox positions itself to be at the forefront of AI innovation in knowledge work.

Additionally, the company announced the launch of Dropbox Ventures, a $50 million AI-focused venture fund aimed at supporting AI startups. This move underscores Dropbox's commitment to AI-driven growth and its belief that AI will be central to the future of work.

3. Future Outlook by AI Analysts

AI as a Catalyst for Growth

Dropbox's investment in AI is central to its growth strategy going forward. Dropbox Dash and Dropbox AI are designed to transform the way users interact with content, providing a more seamless experience across devices and applications. The company’s vision for AI-powered tools is not just to enhance productivity, but also to create new revenue streams. By integrating AI deeply into its platform, Dropbox aims to provide high-value features that justify premium pricing.

Workforce Reductions and New Focus

In April 2023, Dropbox announced the layoff of 500 employees (16% of its workforce), citing slowing growth and the shift towards an AI-centric strategy as key reasons. This restructuring reflects the company’s acknowledgment that growth in its traditional business lines is slowing and that AI is the future. CEO Drew Houston explicitly framed these layoffs as a necessary step to position Dropbox for long-term success in the “AI era of computing”.

While the workforce reduction has improved Dropbox's cost structure, it also signals that the company is consolidating resources to focus on new growth avenues, particularly AI. However, this transition presents challenges, as the company must balance innovation with maintaining its core user base under fierce competition.

Efficient Growth and Competitive Pressures

Dropbox’s pricing strategy will play a crucial role in its ability to capitalize on its AI initiatives and sustain growth. Historically, Dropbox has leveraged a freemium model to attract users and convert them into paying customers. However, with user growth slowing, Dropbox may need to explore new pricing tiers or bundle AI features to increase ARPU.

Tech giants such as Google, Microsoft, and Box have substantial cloud storage offerings that compete directly with Dropbox. These companies have great resources to invest in innovation, making it imperative for Dropbox to differentiate itself through superior AI tools and customer experiences.

References

- Dropbox | SEC filings

- Dropbox | Dropbox Announces Fiscal 2024 Second Quarter Results

- Dropbox | Dropbox Q2'24 Investor Presentation

- Dropbox | Dropbox Q3 2024 and Fiscal 2024 Guidance As of August 8, 2024

- Dropbox | What is Dropbox Business?

- Dropbox | Introducing Dropbox Dash, AI-powered universal search, and Dropbox AI

- Dropbox | Dropbox Dash. AI-powered universal search for work

- TechCrunch | Dropbox launches $50M AI-focused venture fund, intros AI features

- TechCrunch | Dropbox lays off 500 employees, 16% of staff, CEO says due to slowing growth and ‘the era of AI’

- SaaStr | 5 Interesting Learnings from DropBox at $2.5 Billion in ARR

- Medium | Decoding Dropbox: Pricing Strategies That Skyrocketed Success and Traffic

- Google | Google Drive

- Microsoft | Microsoft OneDrive

- Box | The Intelligent Content Cloud

Disclaimer: This content is provided for informational purposes only, and should not be relied upon as business and investment. References to any securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are also for informational purposes solely and should not be relied upon when making any investment decision. We do not guarantee the accuracy or completeness of the information provided.

Please Note: This content was created with AI assistance. While we strive for accuracy, the information provided may not always be current or complete. We periodically update our articles, but recent developments may not be reflected immediately. This material is intended for general informational purposes and should not be considered as professional advice. We do not assume liability for any inaccuracies or omissions. For critical matters, please consult authoritative sources or relevant experts. We appreciate your understanding.